Millennials have entered the marketplace in droves and the pandemic has caused many to re-evaluate their needs and wants in a home. Just as supply is a major component, so too is the demand. By comparison, supply levels reached 11 months in 2008 during a period in which home values appreciated as well - artificial growth consistent with an economic bubble. According to Zillow, our inventory supply today stands at 1.9 months (6 months is considered a balanced market). In this case, our low supply relative to the high demand is contributing to the increase in home values a legitimate economic driver. Any time we see a dramatic change in prices, we can usually attribute it to supply and demand.

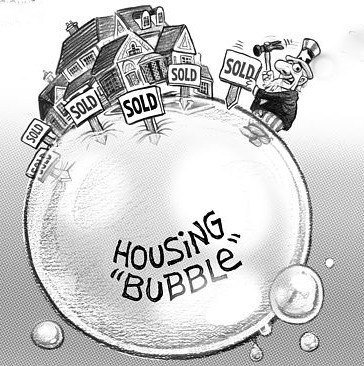

The first of those factors is what we’ve been talking about for the better part of the last year: the housing supply shortage. But fundamentally, there are several major factors that make this highly unlikely. With such a sharp increase in property value amidst a pandemic, and with a moratorium on foreclosures still in place, the concerns may be valid at the surface. With the expectation that home prices will continue to appreciate in 2021, there is some scattered concern that we may find ourselves in a similar housing bubble to that of 2008. Driven by dropping interest rates and limited inventory, home prices surged in the process - roughly 10% on average across the country. Shortly after that, our housing market saw an astronomical increase in activity, recording more real estate transactions in an 8-month period than we had seen in all of 2019.

It’s hard to believe that in just a few weeks, we will mark one year since the COVID lockdowns began across the country.

0 kommentar(er)

0 kommentar(er)